The latest addition to the Ciocca Office of Entrepreneurial Studies is the Finance Boot Camp, a four-day immersion in understanding the institutional framework and career specializations in Wall Street.

Here are six things you need to know about the program.

1. Alumni were the impetus behind the new offering. Loyal alumni eager to help Holy Cross students land jobs in the field of high finance believed that students could be better prepared for their Wall Street job search. They suggested the workshop format.

2. The boot camp covered all major areas of finance. Topics included “Entrepreneurial Finance: Venture Capital & Private Equity,” “Introduction & Overview of the Divisions of Wall Street,” “Wealth Management, Alternative Investment & Hedge Funds,” “Sales and Trading & Equities and Bonds,” and “Investment Banking.”

3. The program was entirely taught by alumni. Like all other COES offerings, the boot camp material was taught by alumni working in the finance sector. “We had a mix of alumni from Boston and New York as well as younger and older alumni. Students could get perspectives from people who are starting their careers in finance and those who hold the highest position within an investment bank,” says David Chu, prebusiness advisor and director of COES. Alumni included Tom Flynn ’87, venture partner at SV Life Sciences, David M. Joy '74, chief market strategist at Ameriprise Financial, Inc., Brendan Johnson '92, managing director at Morgan Stanley, and Corey Maple '11, Analyst at Goldman Sachs.

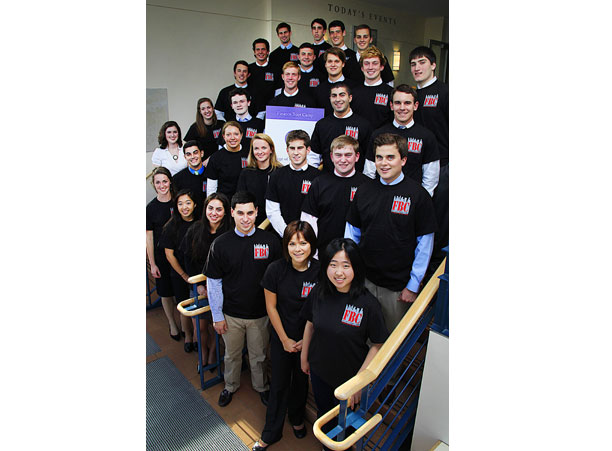

4. Admission was highly competitive. Students interested in taking part in the weeklong program had to apply like they would a job, including submitting a cover letter, resume and recommendations. They were also required to have their application material reviewed by the College’s Career Planning Center. Those who made the cut were interviewed by a COES staff member. Still, that didn’t deter the 78 students from applying. Out of those, only 30 were accepted into the program.

5. It was an honest-to-goodness boot camp. Students were expected to endure long days. One day students worked from 9 to 9, says Chu. “It was intense, as it should be because the students need to get a feel for what it’s like to be working on Wall Street. It’s always changing, you’re always on your toes and you work hard,” he says.

6. The program exceeded students’ high expectations. “It was everything I expected and then some,” says Matt Croglio ’12. “I can’t say enough good things about the alumni who came back. I was very pleasantly surprised to find these very busy alums so invested in our future.” “I gained a broad understanding of how the finance industry operates and all different fields that are open to us,” says Caroline Knuff ’12. Courtney Kokulis ’13 says she is now prepared to answer a number of challenging questions that a prospective employer might pose during a job interview, like “What keeps the chairman of the Federal Reserve up at night?” Xin Yuan ’14 says “getting a job or internship in finance is no longer a mystery.”

Six Things You Need to Know About Finance Boot Camp

Alumni brief students on all things Wall Street in weeklong program

Read Time

2 Minutes